How to sell a house with subsidence

5 minute read

What is subsidence and what sort of impact could it have on the selling process for your home? In this article, we take a closer look at this issue and provide you with some useful tips on how to manage the problem.

Get Home Insurance

Age Co helps homeowners over 50 find the right protection. We are 100% owned by Age UK and our profits go back to the charity.

What does subsidence mean?

In short, subsidence occurs if the ground underneath a property begins to cave in or sink, causing the building itself to shift and move.

Subsidence has the potential to cause lots of problems, especially if the ground beneath the building sinks at different points, meaning that it can become misaligned, which in turn can threaten the structure and foundations of the property.

Signs of subsidence

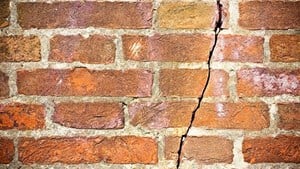

There are a number of tell-tale signs that your home is experiencing subsidence, with the main one being wall cracks.

Wall Cracks

Subsidence can cause cracks on the walls both inside and outside of the property, as well as close to windows and doors. The subsidence cracks are usually bigger than 3mm in width and appear diagonally across the walls.

Not all cracks in your wall are a sign of subsidence, but it's worth checking out anything new that appears especially if it's large.

Other signs of subsidence

Other signs of subsidence in a property may include wallpaper that has a rippled appearance, cracking between the building and an extension, such as a conservatory, as well as door and windows sticking when you try to open and close them.

You may even notice that your home appears or feels wonky or slanted.

How to find out if your property has subsidence

If you’re not already aware that your property has subsidence, it will likely show up when a house survey is conducted on the property. This is usually organised by the person interested in purchasing your home from you.

You may find that your home is more susceptible to subsidence if it has been built on a surface such as clay, or if a large area of trees surrounds the property.

How does subsidence affect property value?

The truth is subsidence can have a significant impact on the value of your home.

If you put your home up for sale knowing that it has subsidence, an estate agent will most likely take this into account when giving you an estimated value of your home. As a result, you may be advised your home is worth less, purely due to the fact it has subsidence.

What’s more, if a potential buyer discovers the property has this issue but they are still interested in purchasing it regardless, they could try to negotiate on the price at the selling stage. In this instance, you may receive an offer that is less than you’d ideally like to sell it for.

How much does subsidence devalue a property?

The level of severity will determine how much subsidence devalues a property. But generally speaking, you could find that it decreases the market value of your home by as much as 25% [1].

To find out how much your property is worth, you’ll need to organise to have it valued by an estate agent.

Selling your house with subsidence

Even though it’s not ideal, the good news is, it is possible to sell your home even if it has subsidence ‒ there are just a few things you might want to do first.

Check out our tips below on how to sell your property if you’re experiencing this problem.

Get in touch with your home insurance provider

If you’re keen to sell but you’ve found out that your property has subsidence, it’s important to get in touch with your home insurance provider.

Your insurer will need all of the details of the problem, and it’s important that you notify them as soon as you’ve discovered your home has subsidence.

It may be difficult to get insurance on a property with subsidence, as not all insurance providers will cover it, and it may be costly to fix.

Alert your estate agent and mortgage lender

You must also notify your estate agent and mortgage lender to see what impact this may have on the sale of your house and mortgage.

It may be difficult to get insurance on a property with subsidence, not all insurance providers will cover it, and it may be costly to fix. The outcome of this can vary from lender to lender and the terms of your mortgage and level of buildings insurance.

Be transparent with potential buyers

Don't be tempted to conceal any subsidence issues from potential buyers. In all likelihood, they'll perform a survey of the property while it's under offer.

Should they find any undisclosed issues, they might want to renegotiate the price or even pull out from the sale. You'll save time and remove uncertainty by being transparent from the start.

Summary

Concerned subsidence might be an issue while selling your home? Keep these key points in mind:

- Subsidence occurs if the ground underneath a property shifts, causing the building to move.

- Wall cracks are the main tell-tale signs, as well as wallpaper beginning to have a rippled appearance. If you think subsidence is present, this can be confirmed through a survey.

- Unless fixed, subsidence is likely to devalue your home – an estate agent will be able to give the best estimate of how much.

- You must disclose any subsidence issues to your home insurance provider and should also alert your mortgage lender and estate agent too.

If you're looking for more expert home advice, try exploring the rest of our Useful Articles.

Sign up to the Age Co Newsletter

Each month, our email newsletter delivers inspiring stories, practical guides to later life, plus the latest news about Age Co and the charitable work we support.